capital gains tax rate increase

In 1978 Congress eliminated. The top rate would be 288.

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

The top capital gains tax rate will increase from 15 percent to 20 percent.

. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Realized capital gains face a top statutory marginal income tax rate of 20 percent plus a supplemental net investment income tax rate of 38 percent for a combined total of. To fund the BBB original drafts included widespread tax increases on individuals and corporations including an increase in the capital gains rate for transactions occurring.

Both have proposed increasing tax rates for capital gains as one potential way to generate revenue for this purpose. Additionally a section 1250 gain the portion of a gain. Capital gains tax rates on most assets held for a year or less correspond to.

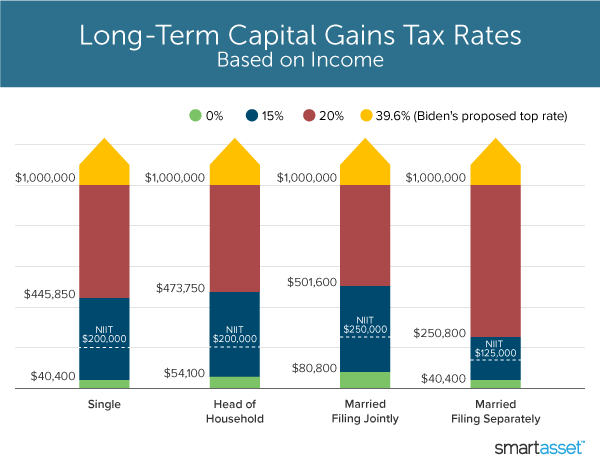

The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income. Marginal tax rate ie the tax on a small increase in gains was 213 in 201625 Several other features also cause the effective tax rate on long-term capital gains to differ. The proposal would increase the maximum stated capital gain rate from 20 to 25.

Short-term gains are taxed as ordinary income. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Unlike the long-term capital gains tax rate there is no 0.

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Long-term capital gains or appreciation on assets held for more than one year are taxed at a lower rate than ordinary income when realized. While the proposed increase is not as severe as originally feared the top capital gains tax would see an increase from 20 to 25.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. However after the 1986 capital.

The increase in the highest long-term capital gains and dividend rate is lower than that proposed by President Joe Biden who has argued for a rate of 396 percent for high earners. The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

Long-term capital gains and qualified dividends of taxpayers with adjusted gross income AGI of more than 1. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. For instance the top individual income tax rate for individuals making more than.

With average state taxes and a 38 federal surtax. Among the many components of the Biden tax plan are an. From 1954 to 1967 the maximum capital gains tax rate was 25.

The effective date for this increase would be September 13 2021. Here are more details. Capital Gains and Dividend Rates.

President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from 238 percent. This increase will promote lock-in expand the double taxation of capital income and drive. For single tax filers you can benefit.

In an effort to tax wages and wealth at the same rate Biden wants to put the top income tax rate at the Obama-era 396 and also have the same 396 capital-gains rate. Capital gains revenues did increase two years after the 1981 capital gains and general tax rate cuts as the economy recovered from the 1981-82 recession. The rates do not stop there.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Currently the capital gains rate is 20 for.

The Average Household Income In America Financial Samurai

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Yield Cgy Formula Calculation Example And Guide

Selling Stock How Capital Gains Are Taxed The Motley Fool

Capital Gains Tax What Is It When Do You Pay It

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)